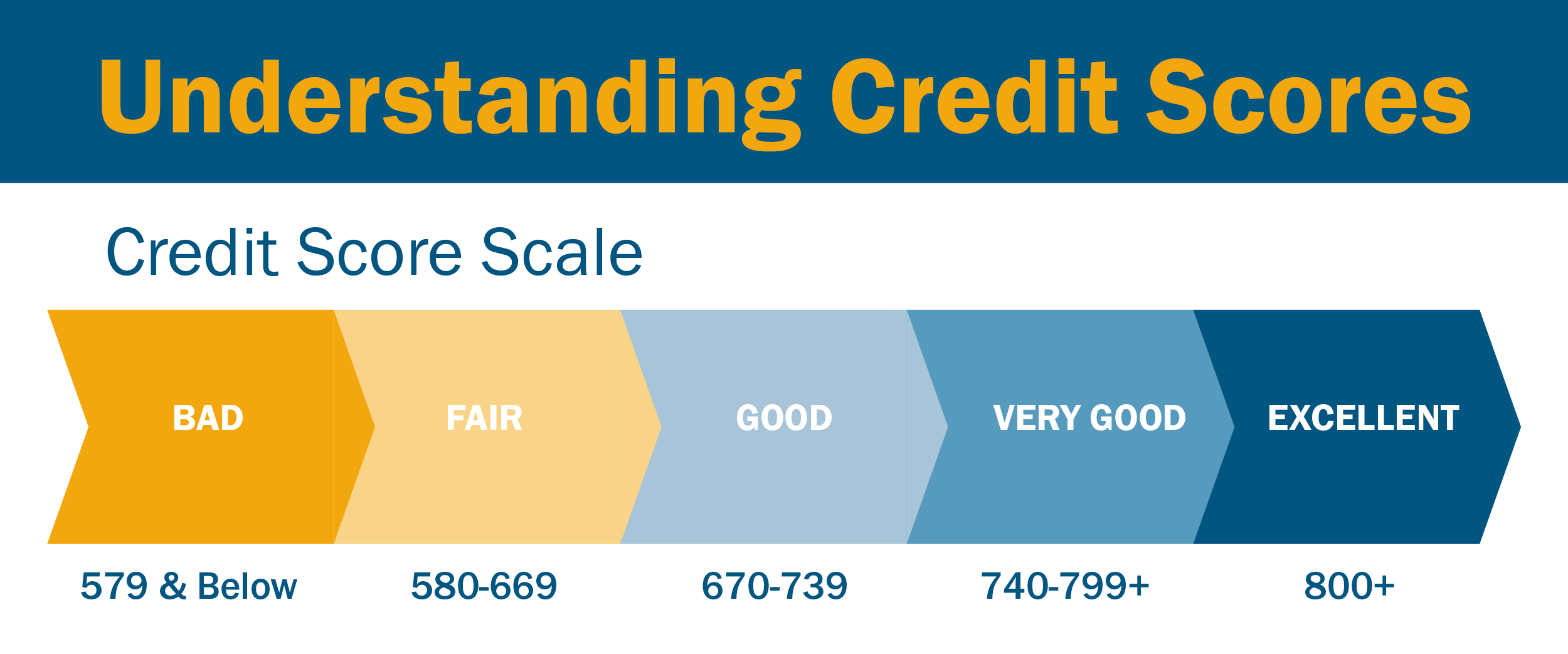

You might even have a collection notice or two against you. Having a score in this range means that you probably have too much debt or more than a few late payments. Here is where things can start getting kind of dicey. If have a credit score between 630 and 679, you have fair credit. Not super high, mind you, but these folks are definitely paying a bit extra to borrow money. And no matter what kind of loan they’re taking out, their rates are going to be higher than people who have great credit. People with scores in this range might be seen as a riskier bet, but they’re still likely to be approved for a personal loan. It could mean that your credit card balances are kind of high, or that you’re still dealing with some student loans. It’s still above average.Ī score in this range probably means that your credit history isn’t quite as long, or that there were one or two bills you had forgotten to pay. Sure, you should definitely strive to improve your credit score-higher is always better-but by no means should you be freaking out about your score. There is nothing wrong with having a score in this range. If have a credit score between 680 and 719 you have good credit. Plus, a score in this range will likely mean additional credit card rewards and perks. While having a credit score of 720 might not entitle you to very best interest rates-those are usually reserved for people with scores 760 or higher-it still means that you will be saving thousands of dollars in interest. These scores mean that you make your payments on time, that you don’t max out your credit cards-it might even mean that you don’t carry any balance on your cards from month to month-and it also means that your debt load is manageable compared to your income.

If have a credit score of 720 or above, congrats! You have great credit!Ī credit score in this range is what everyone should be striving for. And since a credit score is like a grade, we thought it might be nice to translate some of those score ranges into letter grades. According to Lesavich, “About 90% of all lenders use FICO credit scores to determine creditworthiness.”įICO scores are based on scale of 300-850 (300 is the worst score and 850 is the best). While each of the credit bureaus can produce their own version of the credit score, the most common kind of score is the FICO score.

The best way to explain credit scores is that they’re like a letter grade on your credit report: Just like getting an A is an easy way to tell if you did well on your math test, having a credit score of 780 is a fast way for lenders to see that, yup, you have a great history of using credit responsibly. They’re based on the information in your credit reports, which are compiled by the three major credit bureaus-Experian, TransUnion, and Equifax-and contain data on how much money you’ve borrowed, whether you make your payments on-time, etc. Your credit scores don’t just magically appear out of nowhere. Of course, if you have a particularly poor credit score, it might feel less like a fact and more like a cruel joke.Īttorney and best-selling author of The Plastic Effect, Stephen Lesavich says, "Like it or not, decades of research have shown that a person’s credit score can be used directly to predict risk in underwriting of both credit and insurance.” A great credit score opens up financial opportunities-like being able to afford new house or car-that aren't as widely available to those with not-so-great scores.

0 kommentar(er)

0 kommentar(er)